Best Loans for Bad Credit in December 2025

LendingTree users with a credit score below 580 receive 5+ personal loan offers on average

Best bad credit loan lenders with the lowest rates

How LendingTree works

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

1. Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

2. Shop your offers

Our users get 18 personal loan offers on average. Compare your offers side by side to get the best deal.

3. Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

Estimate how much you’ll pay — even with bad credit

What to know about bad credit loans

- Bad credit is a FICO Score below 580.

- You can still get approved for a loan with bad credit, but your loan will likely be expensive.

- Strategies like adding a co-borrower or applying for a smaller loan can help you get approved with lower rates.

You might be worried about whether you’ll qualify for a personal loan, given your credit history. The good news? There are a lot of ways to borrow money with bad credit, and LendingTree users with a credit score under 580 received up to $43,553 for a personal loan in the first half of 2025.

Here’s the hard part: It costs more to borrow money when you have bad credit, and there are a lot of unaffordable options. Personal loans can be a solid solution when they come from lenders with reasonable interest rates. But you should steer clear of offers with rates above 36%.

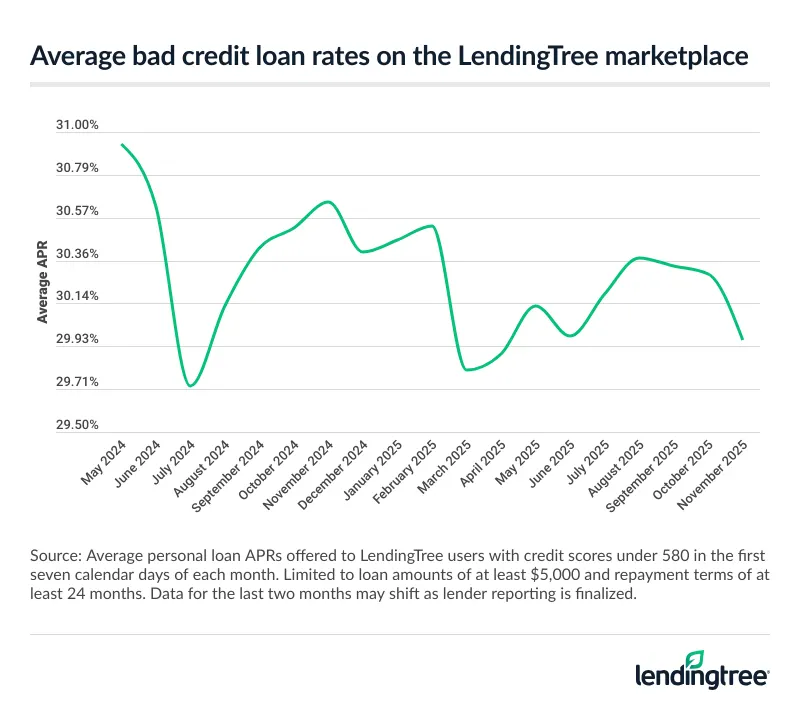

Bad credit loan rate trends over time

Average rates for bad-credit borrowers have stayed below 31.00% for over a year, and below 30.50% for most of 2025.

Types of loans for bad credit

This article focuses on unsecured personal loans for bad credit, but there are other options that may be a better fit for you.

| Loans for bad credit | Best if… | What are they? | Pros and cons |

|---|---|---|---|

| Secured loans | You have collateral you can lose | Loans backed by collateral like a car, home or savings account | Pros: Easier to get, lower rates Cons: Risk losing your collateral if you can’t make payments |

| No-credit-check loans | You need a smaller loan that you can pay off fast | Personal loans with no credit check and/or apps that allow you to borrow money | Pros: No credit check, can get online Cons: High rates/fees, apps can lead to overborrowing |

| Joint personal loans | You have a supportive family member/friend willing to back your loan | Loans you get with another person who is equally responsible for repayment | Pros: Easier to get, lower rates Cons: Missing or late payments will hurt both of your credit scores |

| Cash advances | You have a financial emergency and need fast cash | Small, short-term loans that you can get by withdrawing cash directly from your credit card | Pros: No credit checks, fast cash Cons: Potential fees and high rates |

| Payday loans | You can afford high fees and can pay it off fast | Small, expensive loans that you pay back in two to four weeks | Pros: No credit checks, fast cash Cons: APRs up to 400% could trap you in a cycle of debt |

| Pawnshop loans | You have something of value to offer the pawnshop that you can lose | Small, short-term loans offered by pawnshops and backed by collateral | Pros: No credit checks, fast cash Cons: Chance to lose collateral, high fees |

| Car title loans | You understand the risk of using your car as collateral and have no other options | Short-term loans that are backed by your car | Pros: No credit check, fast cash Cons: Rates are high, could lose your car |

How to choose a loan when you have bad credit

| Situation | Strategy | Next steps |

|---|---|---|

| You have several offers from different lenders | Choose the loan with the lowest total interest that has monthly payments you can afford. | Use a personal loan calculator to compare both monthly payments and total interest. |

| You only have a couple of options, and they’re expensive | See if you can manage the payments, and if not, choose an alternative. | See if the monthly payments fit in your budget. If you can’t afford them, use the expert strategies below to get better rates. |

| You don’t qualify | Choose a strategy to improve your odds when you apply again. | Evaluate strategies and consider alternatives like family loans and payday alternative loans. |

Find a bad credit loan with LendingTree

1. Tell us what you need

Fill out one quick form so we can find your best offers. It takes just a few minutes, and checking rates won’t hurt your credit score.

2. Compare free offers

LendingTree has America’s largest lender network. Compare offers from up to five lenders and watch banks compete for your business.

3. Apply and win

Once you find an offer you like, it’s time to formally apply. After you get your bad credit loan, use it to pay off your credit cards, medical bills or most any other debt that you’re juggling.

How to improve your chances of getting approved

Getting a loan if you have bad credit can be hard, but certainly not impossible. Finding a friend or family member willing to be a cosigner or co-borrower can significantly boost your approval chances, especially if that other person has a longer and better credit history than you.

But you’re more than a credit score, and that isn’t the only thing lenders consider. Your income, employment history and even education level can be green flags, too. Finding stable employment and boosting your income could give you an ‘in’ with some lenders.

How to spot scams for bad credit loans

Some bad credit loans really are too good to be true. To avoid being scammed by a shady lender, be on the lookout for the signs below:

-

High APRs and expensive fees

Expensive loans aren’t technically scams, but they can do a number on your budget. Take control by shopping around for lower rates and skip offers with APRs above 36%. Also, check your offer for upfront fees — you shouldn’t have to pay any fees out of pocket until you start repayment. -

Negative lender reviews

Before you sign, read online personal loan reviews for your potential lender. Pay attention to recurring complaints from current customers. This can help you avoid similar frustrations or decide to pass on the lender altogether. -

Pressure to act

If a lender is pressuring you to make a decision within a small window of time, that’s a red flag. A reputable lender won’t corner you and will give you time to think about your options. -

No physical address

A reputable lender will have the company’s physical address listed on its website (not a post office box), and you’ll be able to confirm it with Google Maps or a similar app. -

They contact you

If a lender contacts you but you haven’t applied or completed a form with them before, don’t respond. It could be a scam to steal your financial information. Legitimate lenders won’t cold call and ask for your personal information. -

No credit check

A reputable lender won’t guarantee loan approval before checking your credit score and report.

Contact law enforcement and file a police report. There may not be much the police can do, but it’s important to document the crime. You should also report the scam to the FTC Internet Crime Complaint Center to potentially prevent others from being scammed in the future.

Why use LendingTree?

$6.4M in funding

In 2024 alone, LendingTree helped find funding for over $6.4 million in personal loans for people with credit scores of 580 or lower.

$1,659 in savings

Lendingtree users save $1,659 on average just by shopping and comparing personal loan rates.

309,000 loans

In 2024, LendingTree helped find funding for over 309,000 personal loans.

Why trust our methodology?

LendingTree’s writers and editors diligently vet dozens of lenders to narrow down which ones offer the most affordable rates and a customer-centered experience. We have ongoing conversations with loan companies to ensure accuracy and collect first-person feedback to understand the holistic process of getting and repaying a loan.

Using my financial health counseling certification, I’m here to walk you through the important — and sometimes stressful — process of understanding your personal finances and credit.

Amanda’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

Frequently asked questions

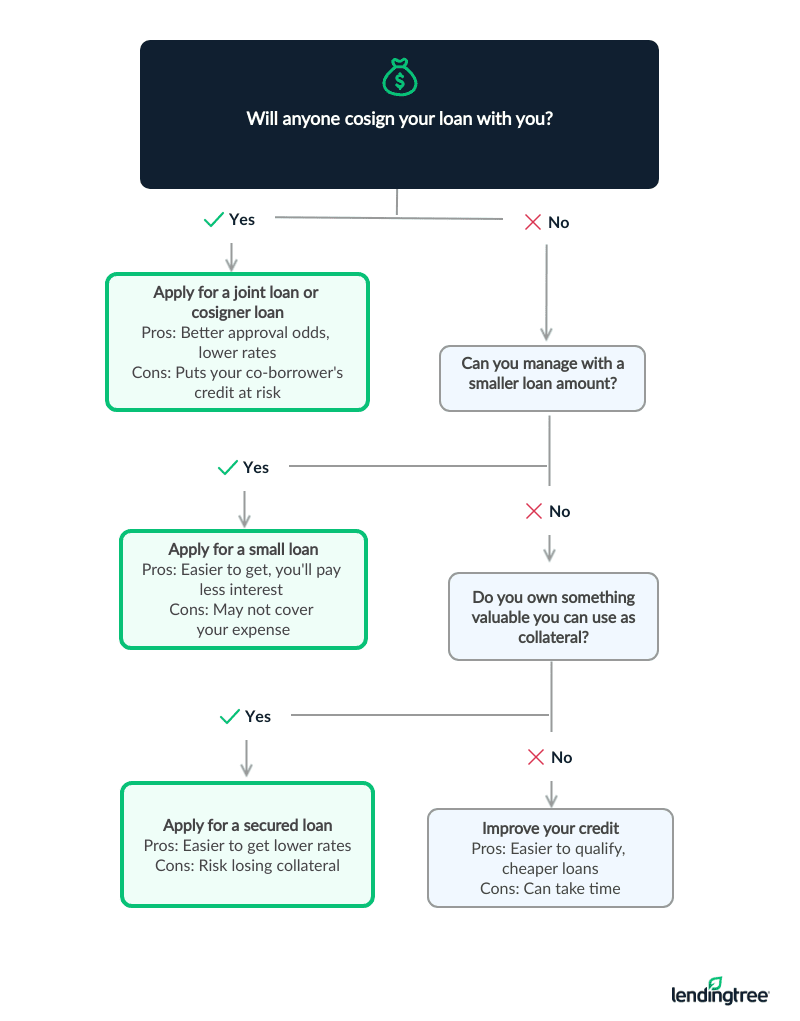

Check out our expert tips on how to improve your chances of approval. The short version? Apply with a co-borrower, take out less money, use collateral or take the time to improve your credit.

Yes, your credit score will drop when the lender pulls your credit. As long as you make payments on time, any drop will likely be temporary and small.

Our methodology

LendingTree’s team of expert writers and editors reviewed more than 30 lenders and lending platforms — and shopped directly with 15 of them — to find the best personal loans for bad credit. To make our list, lenders must advertise a minimum credit score of 580 or lower and cap their annual percentage rates (APRs) at 36%.

According to our systematic rating and review process, the best personal loans for bad credit come from Best Egg, Upstart, Upgrade, Avant and OneMain Financial. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Accessibility. We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms. We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience. We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.