When and How To Refinance a Personal Loan

Best personal loan refinance rates from 6.24%

Best personal loan refinance lenders with the lowest rates

Best for: Support during financial hardship – Discover

- APR

- 7.99% – 24.99%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

- May be willing to work with you if you’re having trouble paying

- Will quickly send loan proceeds to your old creditors

- No fees

- With a maximum loan amount of $40,000, it might not be a good fit if you have a lot of debt to refinance

- Borrowers won’t qualify with bad credit

- No joint loans

If you want a financial safety net for unexpected events like a job loss, LightStream is worth considering. It offers a program designed to help borrowers if they’re having a hard time keeping up with their payments. Your account must have been active for the previous six months to qualify.

If you’re looking for a personal loan with no origination fee, LightStream also fits that bill. It doesn’t charge any fees at all.

A LightStream personal loan isn’t easy to qualify for, however. It requires very good credit and a moderate income. LightStream also doesn’t offer joint applications, so you’ll have to qualify based on your credit alone.

You’ll need to meet these eligibility criteria to get a LightStream personal loan:

- Age: Be at least 18 years old

- Citizenship: Have a Social Security number

- Administrative: Have a physical address, email address and internet access

- Income: Minimum income of $40,000 (individually or as a household)

- Credit score: +

Best for: Beating competitors’ rates – LightStream

- APR (With discounts)

- 6.49% – 25.29%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent auctor magna eu enim fringilla, eget lobortis mi cursus. Proin accumsan feugiat augue non consectetur. Phasellus tempor lectus magna, vel sagittis lorem tristique et. Nulla vulputate sollicitudin venenatis. In hac habitasse platea dictumst. Etiam varius velit tellus, et sagittis erat consequat ut. Morbi ut dui nec felis rhoncus feugiat. Duis non ante in nibh tincidunt porttitor. Phasellus sed metus nunc. Aenean faucibus elementum libero eu mollis.

- May beat a competitor’s rate through the Rate Beat program

- Can get your funds the same day you apply

- No fees

- Won’t pay off your personal loans directly

- Must have at least $5,000 to refinance

- Can’t check rates without a hard credit pull, which can ding your credit

- Doesn’t refinance its own loans

LightStream is an online lender with a unique rate-matching program called Rate Beat. If another lender offers you a similar loan with a lower rate, LightStream may beat it by 0.10 percentage points. Loan shopping and refinancing go hand in hand, so keep Rate Beat in mind while comparing loan options.

You can’t prequalify for a loan with LightStream. That means it requires a hard credit check if you want to see if you’re eligible. It also won’t pay off your existing loans for you. Instead, you’ll have to send the funds to your old personal loan company (or companies) yourself.

LightStream doesn’t specify its exact credit score requirements, but you must have good to excellent credit to qualify. Most of the applicants that LightStream approves have the following in common:

- At least five years of on-time payment history on a variety of accounts (credit cards, auto loans, mortgages and other types of debt)

- Stable income and the ability to afford current debt obligations

- Savings, whether in a bank account, investment account or retirement account

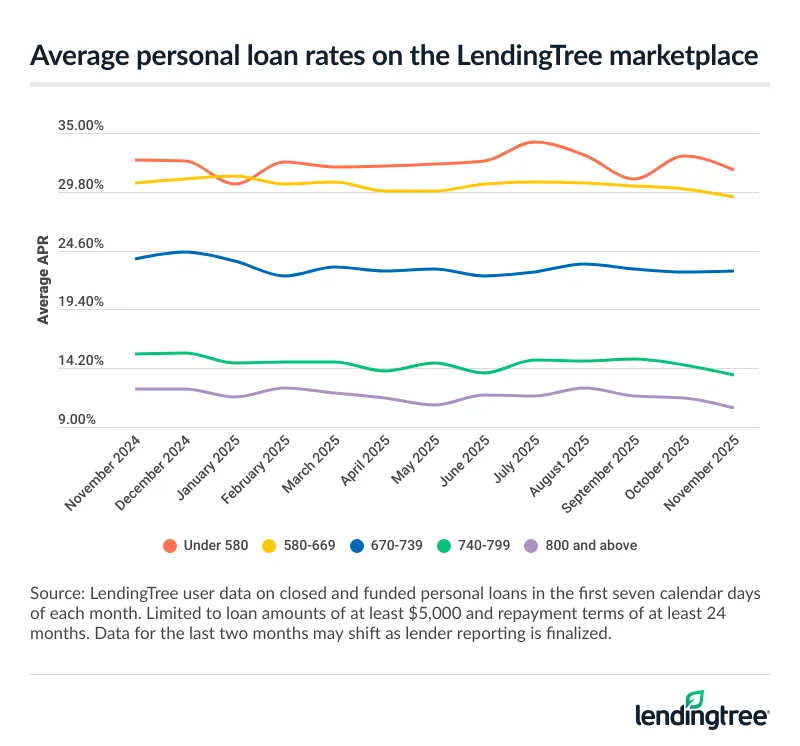

Personal loan refinance rates

Below are the average personal loan rates that LendingTree users found through our marketplace in the second quarter of 2025. Find your credit tier and check what rate you might get.

| Credit tier | Average APR |

|---|---|

| Excellent (800+) | 11.66% |

| Very good (740-799) | 14.35% |

| Good (670-739) | 22.83% |

| Fair (580-669) | 30.22% |

| Poor (under 580) | 32.09% |

Track personal loan rates with LendingTree

Personal loan annual percentage rates (APRs) haven’t changed significantly over the last year, but they have ticked up slightly in recent months — except among those with bad credit. Our data shows that if you have a credit score of 669 or less, you may find that refinancing your current personal loan is more affordable than it was just a few months ago.

See how your refinance loan rate compares to your current loan

Why do millions of Americans trust LendingTree?

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

When banks compete, you win

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and connect with our network of banks and other trusted lenders.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

Our users get 18 personal loan offers on average. Compare your offers side by side to get the best deal.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

What is personal loan refinancing?

Refinancing a personal loan is the act of replacing your current personal loan with a new one. Personal loan refinancing can make your debt more affordable by:

- Reducing your total interest if you qualify for a better rate

- Lowering your monthly payment by refinancing to a longer term

- Helping you pay off debt faster by refinancing to a shorter term

How to refinance a personal loan

Personal loan refinancing sounds complicated, but it doesn’t have to be. Here’s how to get started.

-

Calculate how much personal loan debt you have

You can refinance one loan or several at once (called debt consolidation). Add up your balances so you know how much money to apply for. -

Prequalify for refinancing

Check rates on the LendingTree marketplace without hurting your credit. See if you can save with a new interest rate or a lower monthly payment with a longer loan term. -

Choose a lender and close the loan

Some lenders pay off your old loan directly. Others give you the money, which you’ll use to pay off your previous personal loan. -

Start repayment

Your first refinance payment is usually due within 30 to 45 days. From then on, you’ll only make payments on the new loan.

How personal loan refinancing can save you money

Refinancing a personal loan to one with a lower rate can reduce your total interest and lower your monthly payment. Even if the rate drop seems small, you could save thousands of dollars over the life of your loan.

| Scenario | Original loan | Refinanced loan | Difference |

|---|---|---|---|

| Loan balance or amount | $20,000 | $20,000 | – |

| Loan terms | 60 months | 60 months | – |

| APR | 23.00% | 14.00% | 9.00% |

| Monthly payment | $564 | $465 | -$99 |

| Total interest paid | $13,829 | $7,922 | -$5,907 |

Step-by-step math

Here’s how we did the math in this example. When you’re comparing loan offers, use LendingTree’s personal loan calculator to see potential monthly charges and interest payments.

1. Original loan: Borrowing $20,000 at 23% APR over 60 months leads to a monthly payment of $508 and $13,289 in total interest paid.

2. Refinanced loan: Borrowing $20,000 at 14% APR over 60 months leads to a monthly payment of $465 and $7,922 in total interest paid.

3. Savings: $13,829 – $7,922 = $5,907 less interest paid over the life of the loan, and a monthly payment of about $99 less.

Borrowers with good credit (credit score of 670-739) qualify for an average APR of about 23% on the LendingTree marketplace. Borrowers in the “very good” category (credit score of 740-799) received an average APR of about 14%.

In this example, moving up just one credit tier saved the borrower close to $6,000 over the loan term. Download LendingTree Spring to get your free credit score along with personalized tips on how to improve your credit.

Other ways that refinancing can help

Refinancing isn’t always about saving on interest. You might be able to reduce your monthly payments by choosing a longer loan term, even if you don’t qualify for a better rate.

By choosing a longer loan term, you’ll break up your balance into more payments. This results in a lower payment each month, but you’ll pay more in interest overall.

Refinancing can also help you get out of debt faster if you pick a shorter loan term. This will condense your debt into a smaller window, increasing your monthly payments but reducing the total interest paid.

When it’s a good idea to refinance a personal loan

Here are three signs that it could be a good time to refinance your personal loan:

- Your credit score has improved — If your credit score has improved substantially since you got your original loan, you might get a lower interest rate by refinancing. A lower interest rate can save you money over the life of the loan.

- Interest rates have gone down — Personal loan rates reached their highest levels since 2007 in early 2024. If this is around the time you took out your original loan, you might qualify for a better rate based on market conditions.

- You need lower payments — When you need to lower your monthly payments, think about refinancing into a longer-term loan. This should lower your payment, but it will also increase the total amount of interest you’ll pay over time.

- You want to pay the loan off faster — If you want to pay off your loan faster, consider refinancing into a shorter loan term. Your monthly payment will go up if you go this route, but you’ll save on interest costs.

When you should wait to refinance a personal loan

Here are three signs you should wait to refinance:

- You can’t get a lower interest rate — Whether interest rates have risen or your credit score has dropped, it may not make sense to refinance if you don’t qualify for a lower interest rate.

- You’re facing a lot of fees — Some personal loans come with an origination fee, which the lender usually deducts from your loan amount. Your current lender could also charge a prepayment penalty (although this is rare). If the fees aren’t worth the possible benefits, refinancing may not be a good idea.

- You can’t afford your debt, even after refinancing — Refinancing won’t change how much you owe. If you have more debt than you can pay, it might be time to consider bankruptcy or debt relief.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

Frequently asked questions

Once you refinance a loan, you can’t reverse the process. It’s important to know the downsides before making a final decision. Some drawbacks of personal loan refinancing include:

- Higher interest charges if you choose a longer loan term

- Possible origination fees with your new lender

- Possible prepayment penalties with your old lender

- A small dip in your credit due to a hard credit pull (usually five points or fewer)

- Could switch to a lender with poor customer service (LendingTree user reviews can help prevent this)

While every lender has its own eligibility criteria, generally, a good credit score (670+) is required to qualify for personal loan refinancing. Lenders typically start offering their best rates once you hit 740+.

Some lenders, like and , accept fair and bad credit scores. Rates may not be lower than what you’re currently paying, but you can still refinance to get a lower monthly payment with a longer loan term.

Lenders also look at other factors, like your debt-to-income ratio (DTI). This is how much you currently owe per month compared to your income. Most lenders prefer a DTI of 35% or less, but the lower, the better.

Because every lender has its own eligibility requirements, the best way to see if you qualify for personal loan refinancing is by prequalifying. It won’t hurt your credit score and will show you what rates to expect from each lender.

Some lenders will refinance their own loans, but not all. LightStream, for instance, won’t refinance its own loans. Although it might feel more comfortable refinancing with your current lender, you should still shop around.

On the LendingTree marketplace, you can check refinance rates with the nation’s largest network of lenders with just one form. It’s possible you might get the best deal from your current lender, but you won’t know unless you compare multiple offers.

Our methodology

We reviewed more than 30 lenders that offer personal loans to determine the overall best six lenders by these metrics. According to our systematic rating and review process, the best personal loans come from Best Egg, BHG Financial, Discover, LightStream, SoFi and Upstart. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Accessibility. We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms. We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience. We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.