Auto Refinance Rates from 3.50%

Last year, LendingTree helped to fund over $498 million in auto refinance loans

Best auto refinance lenders with the lowest rates

Auto refinance rates

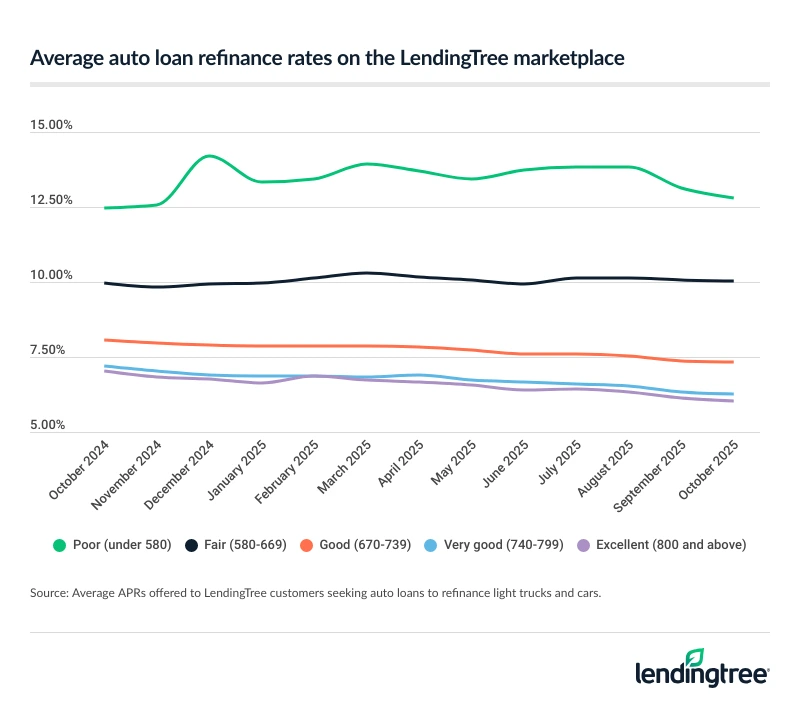

We’ve compiled the average auto loan refinance rates for LendingTree marketplace users so you can estimate the rates you’ll likely qualify for based on your credit score.

| Credit tier | Average APR |

|---|---|

| Excellent (800 and above) | 6.30% |

| Very good (740-799) | 6.48% |

| Good (670-739) | 7.50% |

| Fair (580-669) | 10.10% |

| Poor (under 580) | 13.39% |

Track auto refinance trends with LendingTree

Auto refinance rates vary widely based on credit score. LendingTree data shows super prime borrowers often secured rates under 7%, while subprime rates remained higher.

Estimate how much you’ll save with your auto refinance rate

Expert insights on auto refinancing in 2025

In times of economic uncertainty, what should people remember when refinancing a car?

The most important thing to do when refinancing a car is to make sure that it’s worth the cost. Refinancing doesn’t happen for free, so it is important to crunch the numbers to understand how much you can save by refinancing.

Schulz urges you to consider how much you’d be able to reduce the rate, how high the fees are and how long you’ve had your current loan before making a decision. As appealing as it might be to refinance, the truth is that it won’t work for everyone.

Are you putting the brakes on buying a car because of tariffs? You aren’t alone. We conducted a survey to learn more about car-buying habits in the midst of tariffs. Of those who were planning on buying a car this year, 36% have now decided to wait.

As car costs rise, it may be a smarter move to refinance instead of buy. You’ll have to keep your older car, but you could save money in the meantime if you qualify for a low refinance rate.

Why do millions of Americans trust LendingTree?

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

Should I refinance my car?

Borrowers refinance auto loans after buying a car for a variety of reasons. Here’s when to consider refinancing your car loan:

-

Your credit score has increased

Improving your credit score can boost your chances of qualifying for better rates when you refinance your car loan. You can raise your score by making on-time payments on your current auto loan and by reducing other debts. -

Interest rates have dropped

If interest rates have dropped since you took out your car loan, you may be able to land better rates with a refinance. -

You’re struggling to make payments

If you can’t keep up with your current loan, consider refinancing for a longer term. This can help lower your monthly car payments. Keep in mind that you’ll pay more in interest in the long run. -

You bought at a buy here, pay here

If you bought a vehicle at a buy here, pay here car lot, you are probably paying super-high interest rates. Even if your credit isn’t perfect, you might get a lower rate by refinancing with a legitimate lender. -

You want to add or take someone off of your car title

Most auto refinance lenders let you add or remove co-borrowers during the refinancing process. When you add or remove a co-borrower, you’re also adding or removing them from the title.

A LendingTree study found that refinancing your car loan could save you an average of $142 a month and $1,346 over the life of your loan. If you refinance for a shorter loan term, you could save significantly more — $6,291 on average.

Choosing a shorter repayment term is one of the best ways to save money when you refinance. But if you’re struggling to keep up with payments, a loan with a longer term and smaller payments can help you keep your loan out of default. Just don’t expect to save money on your loan.

Auto refinancing based on credit score

| Your credit band | Strategy | Tips |

|---|---|---|

| Excellent (800 – 850) | Check your rates with lenders that offer the lowest starting APRs, like | Don’t stop at the first offer — you can save even more money by shopping around |

| Good to very good (670 – 799) | Shop around with top refi lenders or use LendingTree to get the best deal | Remember that short loan terms will help you save on interest |

| Fair (580 – 669) | You’ll pay higher rates with fair credit, so find lenders with low maximum APRs or use a marketplace to get the best offer | Add a cosigner or work on improving your credit to get lower rates |

| Poor (300 – 579) | Refinancing now likely won’t save you money on interest overall, so if you can’t afford your monthly payments, ask your lender about hardship programs or consider refinancing with a longer loan term — you’ll pay more, but you’ll have smaller monthly payments in the meantime | Look for lenders with low credit score requirements like and |

Can you refinance a car with bad credit?

You may be able to refinance a car loan with bad credit, but you’ll have to apply with lenders that accept lower credit scores. The auto refinance lender on this list with the lowest minimum credit score is

If you have bad credit, an auto refinance loan could be more expensive than what you’re paying now. But if you’re having a hard time affording your car loan because your monthly payments are too high, refinancing — even with a higher rate — could make sense.

Refinancing your auto loan can give you the option to stretch out your payments over a longer term, providing you with wiggle room in your budget.

Let’s say you owe $15,000 with 36 months left on your loan and you’re paying $470 per month. If you qualify for a 48-month auto refinance loan, you could reduce your monthly car payment to $366.

To do this, focus on the longest car loan that you qualify for, with the lowest rate. Just know that you will be paying more overall interest. Still, if it keeps your car from being repossessed, the extra interest could be worth it.

If you don’t qualify for refinancing and you’re struggling to keep up with payments, contact your lender and ask if it has a hardship program.

You could also see if a lender will approve you if you put a cosigner on your refi loan. Getting someone else to back you up could get you over the finish line, especially if they have excellent credit. You might even get a better rate.

How to get banks to compete for your business with LendingTree

Shopping for a loan shouldn’t mean filling out tons of applications. With one form, compare rates from our network of vetted lenders — when banks compete, you win.

Tell us what you need

Take two minutes to tell us what you need to refinance. We’ll take care of the rest. It’s free, simple and secure.

Shop your offers

We’ll send you offers from up to five trusted lenders. Compare them to see if you can save money or lower your car payment.

Get refinanced

Choose an offer, finalize your loan and you could have the money you need within 24 hours.

Frequently asked questions

Each lender has its own rules for which cars it will refinance. Usually, your car needs to have less than 125,000 or 150,000 miles on the odometer. Most lenders only refinance cars that are 10 years or newer, although there are some exceptions (see ).

Also, your car needs full coverage insurance before you can refinance, and you will likely need to provide an active registration. You may also have a hard time refinancing a car with a salvage or branded title.

Before applying and taking a hard credit hit, make sure your car fits the lender’s eligibility requirements.

Refinancing your car loan can be a good idea if you qualify for a lower interest rate than what you’re paying on your current car loan. This can happen if you’ve improved your credit after buying your car, or if rates in general have dropped.

It might also be a good idea to refinance your car if you want a lower car payment. You can do this by choosing a refinance loan with a longer term. You will pay more overall interest, however.

Some people also refinance in order to add or remove a co-borrower. By doing so, that person will be added or removed from the car title. Adding a co-borrower to your auto refinance loan can help you get a lower rate if your co-borrower has excellent credit.

It can cost money to refinance a car. Some lenders charge doc fees or admin fees, sometimes reaching several hundred dollars. These fees are meant to cover overhead, like filing DMV documents on your behalf. Typically, your lender will roll these fees into your loan, so they aren’t an out-of-pocket expense.

A good auto loan refinance rate is a lower rate than what you’re currently paying. Use an online marketplace like LendingTree to compare multiple offers at once to see if you qualify for a good refinance rate for your car.

Keep in mind, it’s much easier to qualify for a lower interest rate if your credit score has improved since you bought your car.

Based on LendingTree’s research, we found that the best auto refinance lenders are:

It’s usually best to wait at least six months before refinancing your auto loan.

Applying for two loans too close to each other (in this case, your first auto loan and then your auto refinance loan) can be bad for your credit score. If your credit score drops, then your auto refinance rate might be more than what you’re paying on your current auto loan.

Now, how soon you can refinance a car loan will depend on how long it takes for the car title to transfer to you. That can take a few days or more than a month — it varies by state and other factors. Even so, you may want to wait at least six months to refinance, if you can.

Refinancing an auto loan can affect your credit score, since you’ll need to submit to a hard credit pull when you apply for a loan. This can cause your score to drop by a few points temporarily. However, as you repay your car loan, your score will gradually increase again.

You usually don’t need a down payment to refinance a car. A down payment is usually only required when you are upside down on your car loan, or owe more than it’s worth. You might also have to make a down payment to refinance if you have bad credit, but that’s up to the lender.

Our methodology

We reviewed more than 44 lenders and financial institutions that offer auto refinance loans to determine the overall best 10 lenders. To make our list, lenders must offer competitive APRs. From there, we prioritize lenders based on the following factors:

Accessibility: We chose lenders with auto loans that are available to more people and require fewer conditions. This may include lower credit requirements, wider geographic availability, faster funding and easier and more transparent prequalification, preapproval and application processes.

Rates and terms: We prioritize lenders with more competitive starting fixed rates, fewer fees and greater options for repayment terms, loan amounts and APR discounts.

Repayment experience: For starters, we consider each lender’s reputation and business practices. We also favor lenders that report to all major credit bureaus, offer reliable customer service and provide any unique perks to customers, like free wealth coaching.

LendingTree reviews and fact checks our top lender picks on a monthly basis. We partner with dozens of auto lenders, but partners and non-partners receive equal treatment in our systematic scoring and review process.